H&E revenue jumps of 24.5% in 2Q; new equipment sales up 50% | Dump Truck Company

H&E Equipment Services 2Q18 highlights

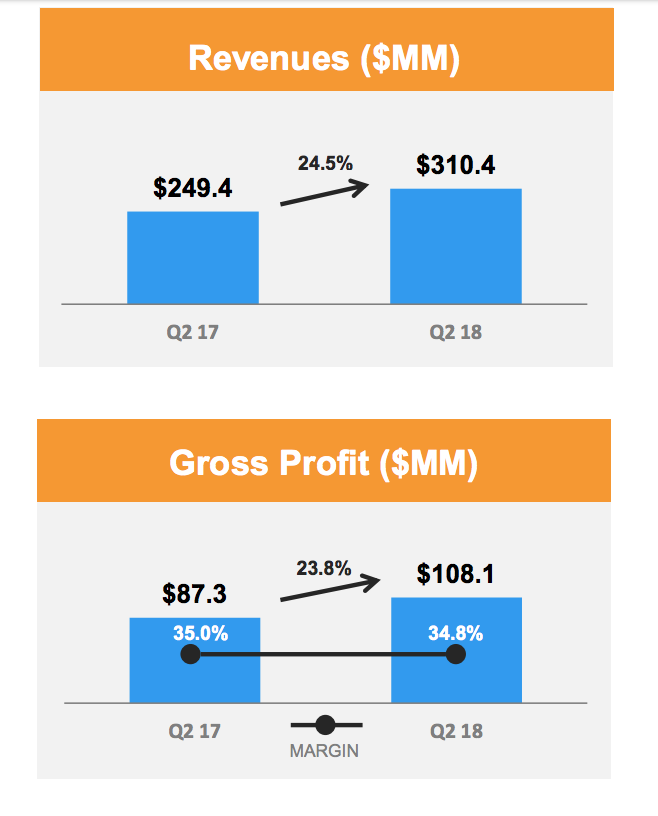

Revenues increased 24.5 percent or $61.0 million.

CEC and Rental Inc. legacy operations contributed $9.8 million and $7.6 million, respectively.

Rental revenue increased 21.5 percent to $143.8 million, versus $118.4 million a year ago.

New charlotte nc dump trucks sales leaped 50.1 percent, or $22.9 million, to $68.5 million.

Gross profit increased 23 percent, or $20.8 million.

With major acquisitions and booming construction activity, H&E Equipment Services posted a total revenue jump of 24.5 percent for the second quarter of 2018.

New charlotte nc dump trucks sales soared by 50 percent – fueled primarily by new crane sales and earthmoving sales, according to CEO John Engquist.

($MM = millions).

“Our business delivered solid results across the board during the second quarter, with our rental and distribution business achieving significant growth from a year ago,” Engquist said in an investors’ conference call Thursday.

He notes solid demand for small crawlers, all-terrain and truck-mounted cranes, though demand for rough-terrain cranes remains challenging. Driving the broad-based increase in crane demand is activity in the oil patch, industrial sector, infrastructure and the construction market, the dump trucks charlotte nc says.

H&E’s total revenues rose by $61 million to $310.4 million, compared to $249.4 million a year ago.

Of that $61 million increase, about $9.8 million and $7.6 million were related to the branches acquired in the Contractors Equipment Center (CEC) and Rental Inc. acquisitions, respectively, according to Leslie S. Magee, chief financial officer and secretary.

Adjusted EBITDA grew 28 percent to $101.8 million. And gross profit increased 23.8 percent, or $20.8 million.

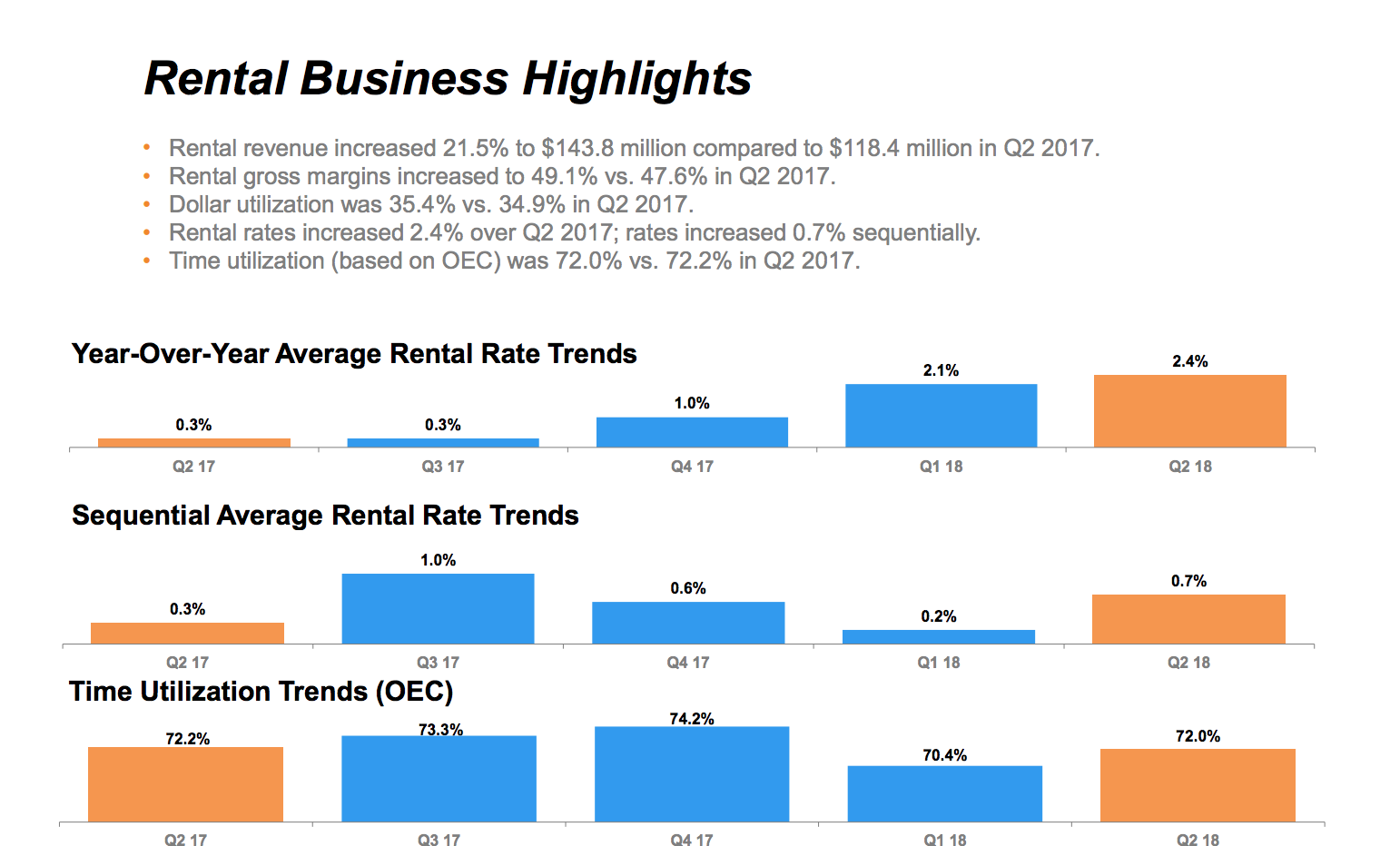

Rental revenue continues gains

Rental revenue shot up by 21.5 percent to $143.8 million, compared to $118.4 million in the second quarter of 2017.

Demand for rental charlotte nc dump trucks was strong during the second quarter, resulting in the 21.5 percent or $25.5 million increase in rental revenue to $143.8 million. That’s up from from $118.4 million a year ago.

That rise resulted primarily from high utilization on a significantly larger fleet, combined with solid increases in rates.

“The trends in our rental metrics are positive, as time utilization remained high at 72 percent,” Engquist says.

“Dollar utilization grew to 35.4 percent from 34.9 percent a year ago. And we achieved positive rates for the fifth consecutive quarter, up 2.4 percent year-over-year and 0.7 percent sequentially. Rental gross margins increased to 49.1 percent from 47.6 percent a year ago.”

Nation’s booming construction activity hit a high in May

The strong earnings report comes as the nation’s construction spending hit record high in May at $1.3 trillion on a seasonally-adjusted annualized basis, according to H&E’s earnings report.

For the second quarter, H&E generated net income of $20.8 million, or 58 cents per diluted share. That’s compared to $9.9 million, or 28 cents per diluted share, a year ago.

Magee reports that used charlotte nc dump trucks sales increased by 33.3 percent, or $8 million, to $32.1 million – largely as a result of higher used crane and aerial charlotte nc dump truck company platform sales.

“Used charlotte nc dump trucks sales related to the branches acquired in the CEC and Rental Inc. acquisitions were $0.2 million and $0.4 million, respectively,” she says.

“Sales from our fleet comprised 89 percent of total used charlotte nc dump trucks sales this quarter, compared to 88 percent a year ago.

“Also, the product line used equipment sales fluctuations included in this presentation do not include the impact of legacy Rental Inc. operation,” Magee says.

“Our parts and service segment delivered $47.1 million in revenue on a combined basis, up 3.1 percent from a year ago.”

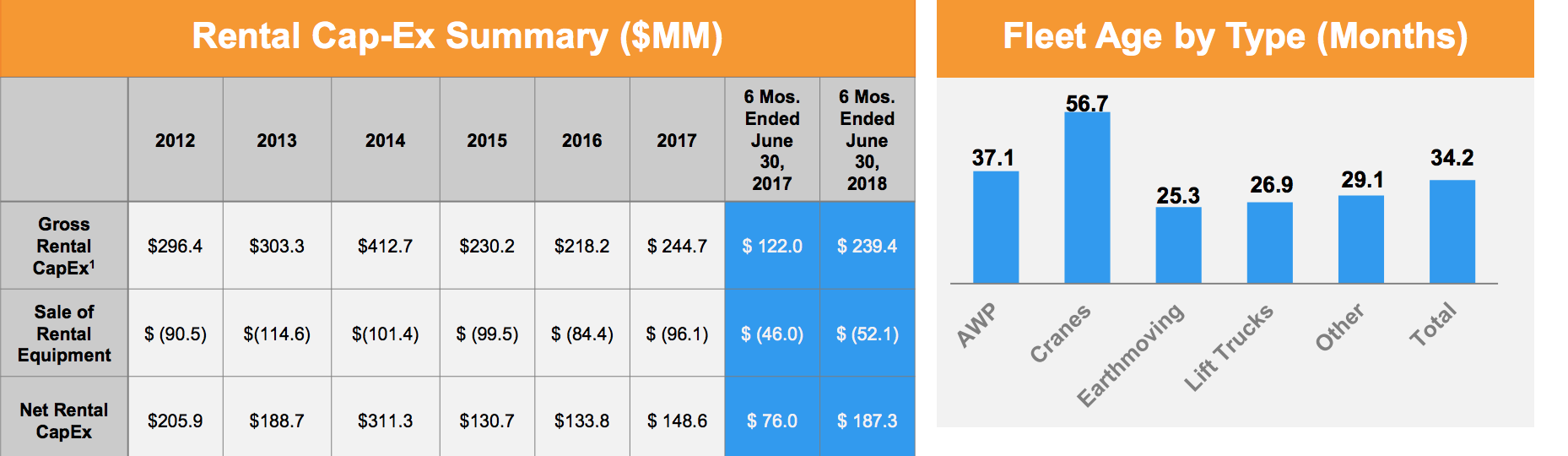

Capital expenditures jump

The dump trucks charlotte nc has significantly increased spending for capital expenditures.

“As you know, the first half of the year, we spent about $240 million on a gross basis,” Engquist noted in the call.

“Our expectation that in the second half of the year, we’re going to spend between $160 million and $180 million. It could fluctuate that much in the second half of the year,” he explains.

“Approximately half of that spending will be for growth capital, and the vast majority of that spend will be in the third quarter. We always pull our capital spending back in the fourth quarter. And all of our growth capital will be in the third quarter.”

With crane sales, it seems the cycle has shifted to an upswing, with cranes on the skylines of many communities.

“We’ve certainly sold some of the new products,” Bradley W. Barber, president and chief operating officer, noted in the call. ” And I’ve got to tell you, the new product, both the quality and engineering, is impeccable by the Manitowoc Group.”

Some of that new products replaced older products of similar size, he explains. “Both the quantity of new products Manitowoc is offering as well as the quality is being well-recognized by the customer base, and I think we benefited from that,” Barber says.

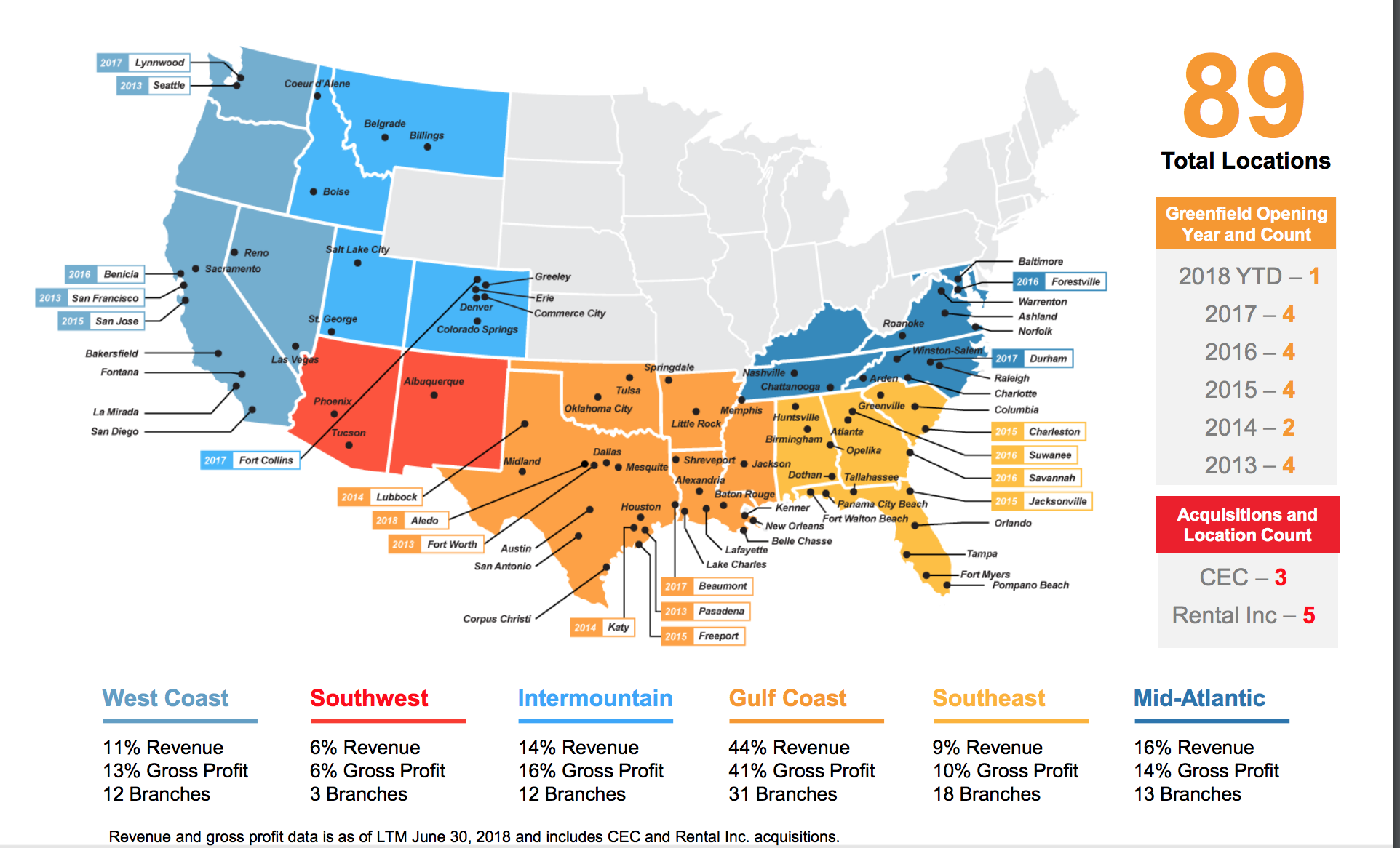

Acquisition strategies to widen footprint

In the company’s nationwide footprint, there are various regions, branch locations, and 19 greenfield sites opened since the beginning of 2013, including sites bought in the CEC and Rental Inc. acquisitions.

“During the second quarter, we opened our first greenfield of the year in Aledo, Texas to expand our presence in the Fort Worth metroplex,” notes Engquist. “We currently have 89 branches located throughout the United States and intend to continue to grow our footprint and business by exploring additional acquisitions, greenfields and warm starts.”

Engquist says H&E’s strategy of increasing size and scale through acquisition is strong and makes sense in every way.

“We’re going to be disciplined in what we pay for assets. And we’ve got a healthy pipeline of opportunities that we’re looking at, and we’re going to pay market multiples for these businesses,” he says.

H&E is focusing on bolt-on type acquisitions – companies generating EBITDA from $15 million to $25 million, Engquist notes. “That’s the bulk of what we’re looking at,” he says. “We would certainly be interested in a larger opportunity if it came along, and we’ll see what develops there.”

Outlook strong into 2019 with solid demand

Engquist says H&E’s outlook for the rest of this year remains positive, with solid demand in end-user markets and continued growth forecast for nonresidential construction markets throughout 2018 and into 2019.

“Industry indicators forecast continued growth in nonresidential construction, and increasing the size and scale of our business is a strategic priority, which we expect to achieve through organic growth, acquisitions and greenfield and warm-start branch expansion.”