ELFF: Moderate growth in construction equipment investment ahead | Dump Truck Company

Construction and agricultural machinery investment growth should see moderate increases next year, according to the Equipment Leasing & Finance Foundation’s 2020 U.S.

economic outlook. The foundation also said that mining and oilfield machinery could improve modestly “but is likely to remain weak overall.”

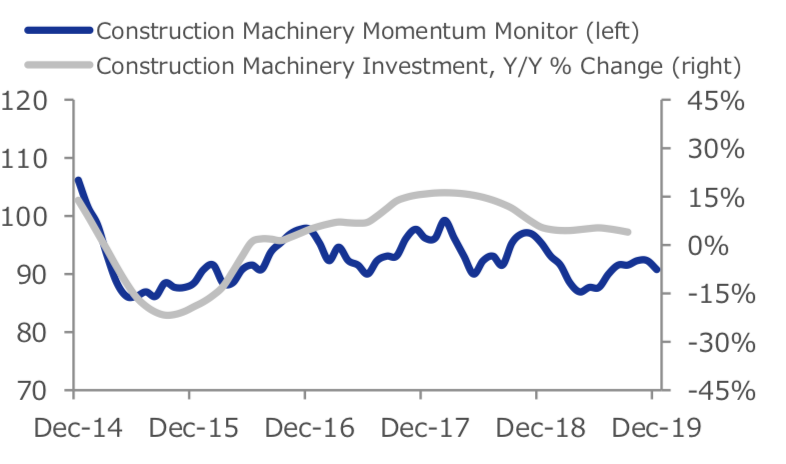

Third quarter construction machinery investment pulled back 6.7 percent (annualized) but rose 4 percent from a year ago, says the foundation. It also indicates the Construction Machinery Momentum Index decreased from 92.3 (revised) in November to 90.8 in December. Overall, the foundation says the index points to modest growth over the next two quarters.

In the agricultural charlotte nc dump trucks sector, investment increased at annualized rate of 2 percent in 3Q 2019 and is up 0.7 percent year over year. The Agricultural Machinery Momentum Index improved from 96.3 (revised) in November to 97.9 in December. The foundation says the index suggests that growth in the sector will improve over the next three to six months.

Investment in mining and oilfield machinery fell at a 28 percent annualized rate in 3Q 2019 and is down 8.9 percent year over year. The Mining & Oilfield Machinery Momentum Index improved from 100.0 (revised) in November to 102.5 in December.

Overall, says the foundation, charlotte nc dump trucks and software investment is “on track to post its weakest year of growth since 2016, weighted down by an annualized contraction in Q3 — the first negative reading in over three years.” It expects total charlotte nc dump trucks and software investment to expand 1.1 percent in 2020, down from an estimated 3.6 percent in 2019.

U.S. capital and credit markets saw a contraction in 2Q and 3Q of 2019 and are “expected to remain muted in early 2020, in large part due to the ongoing trade war with China and other slowing economies around the world,” says the foundation, but adds that “credit market conditions remain broadly healthy.” It also says that demand for credit — especially by business — has weakened notably and may mean a further slowdown in business investment next year.