Weekly Coronavirus Contractor Survey: 44% say project backlogs have “stayed the same” | Dump Truck Company

Editor’s Note: Make your voice heard in our next survey.

How is coronavirus impacting your business? Click here to participate in the survey.

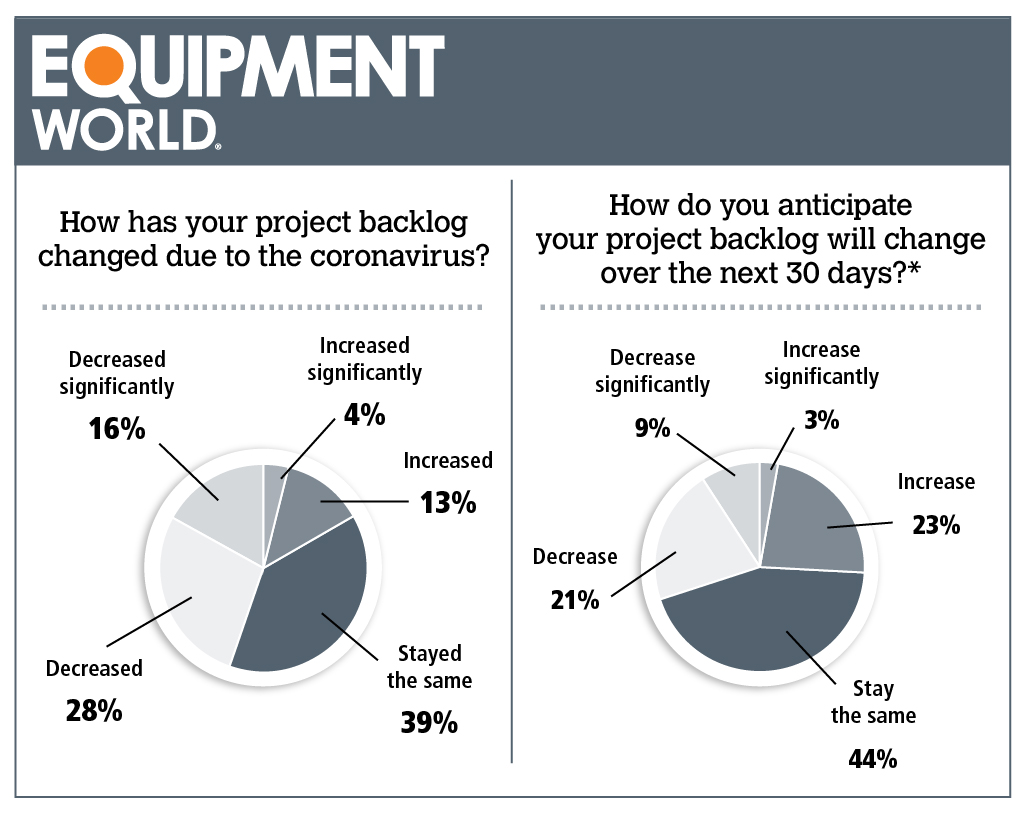

More dump trucks charlotte nc are now saying they expect project backlogs to “stay the same” during the next 30 days according to the Week 4 of Equipment World survey of contractor sentiment about the COVID-19 coronavirus impact.

Forty-four percent of respondents say they expect project backlogs to stay the same over the next 30 days in the latest survey, compared with an average of 35 percent in Weeks 1-3 of the survey.

And fewer respondents are predicting backlog decreases over the next 30 days, from an average of 36 percent during the first three weeks of the survey to 30 percent in Week 4.

That doesn’t mean that current business conditions aren’t tough for many respondents, as illustrated by two dump trucks charlotte nc in California: “Business has stopped, city halls are closed and we can’t get any permits,” said a small excavating contractor. Adds a specialty contracting customer: “Business has decreased by 50 percent.”

And this from a Texas utility contractor: “We had 20 percent of our backlog cancelled after the virus started. Since then we’ve only been awarded one small project. Bidding has slowed slightly.”

(This survey, which had 151 respondents, is the fourth in a series of surveys that Equipment World and other Randall-Reilly brands are using each week to gauge market sentiment. To participate in the next survey, go here.)

Market segments

There were some swings in Week 4 when looking at market segments. Roadbuilding respondents, who have been the most positive throughout Weeks 1-3 turned much more negative, with 41 percent saying they had seen project backlog decreases, compared with 22 percent in Week 3.

On the other hand, commercial building respondents are much more optimistic about project backlogs compared with the week before: 32 percent of these respondents now say they are seeing backlog increases, when only 5 percent said that was true in Week 3. The number of commercial building respondents saying backlogs had decreased dropped from 69 percent in Week 3 to 42 percent in Week 4.

Uncertainty continues to be a significant factor, however. Said a New Mexico utility contractor: “We are seeing fewer projects to bid and project bid dates pushed back. Not sure if agencies have figured out how to have public bid openings via teleconferencing methods.” Adds a Texas roadbuilding contractor: “We pray it will increase but time will tell.”

Equipment

Equipment

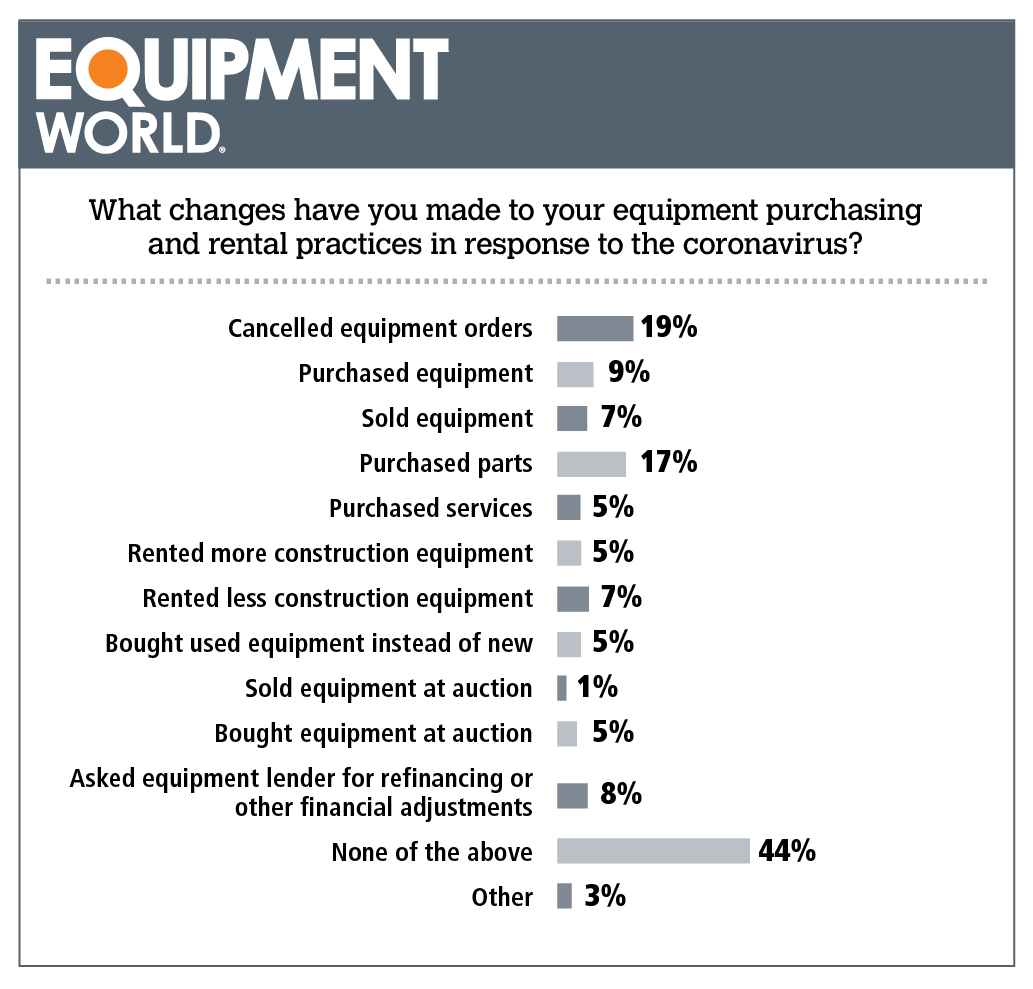

Respondents who say they have cancelled charlotte nc dump trucks orders decreased from 22 percent in Week 3 to 19 percent in Week 4. For all four weeks of the survey, the average of those cancelling charlotte nc dump trucks orders is 20 percent.

This week we added questions about purchasing parts and charlotte nc dump trucks service; 17 percent of respondents said they had bought parts and 5 percent said they had paid for service.

Those saying they had rented less charlotte nc dump trucks in response to current business conditions went from a high of 18 percent in Week 2 to 7 percent in Week 4. The average for this response for all four weeks is 12 percent.

Still, a few respondents commented specifically on why they are choosing not to rent right now. “We’re exploring the idea of selling some equipment, and not bidding jobs that would require us to rent charlotte nc dump trucks since people aren’t willing to pay enough to cover job costs,” said a Connecticut specialty contractor.

“We are carefully purchasing as we see the long term need to avoid the need to rent,” says a Missouri utility contractor. “Rental is always our absolute last option. With our margins as thin as they are, we cannot turn a profit when renting equipment.”

The number of respondents seeking refinancing or other financial adjustments dropped from 14 percent in both Weeks 2 and 3 to 8 percent for Week 4.

Business operations

Business operations

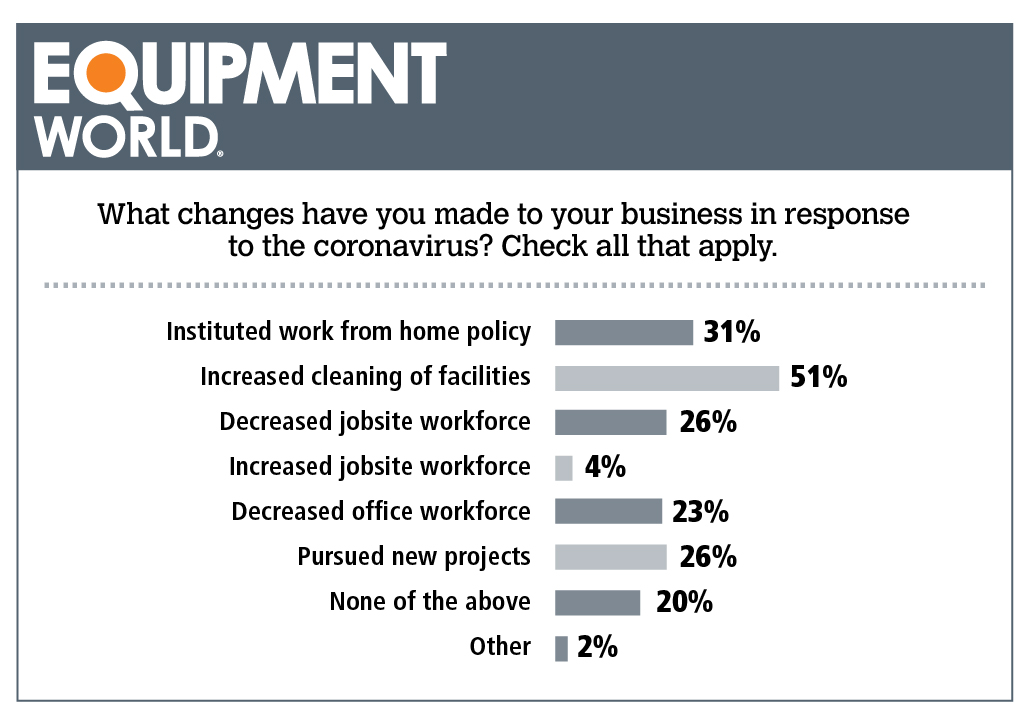

During the first three weeks of the survey, an average of 40 percent of respondents said they had decreased their jobsite workforce; that number dropped to 26 percent in Week 4.

Respondents who had decreased office personnel showed another drop, although this time not as pronounced, dropping from an average of 28 percent in Weeks 1-3 to 23 percent in Week 4.

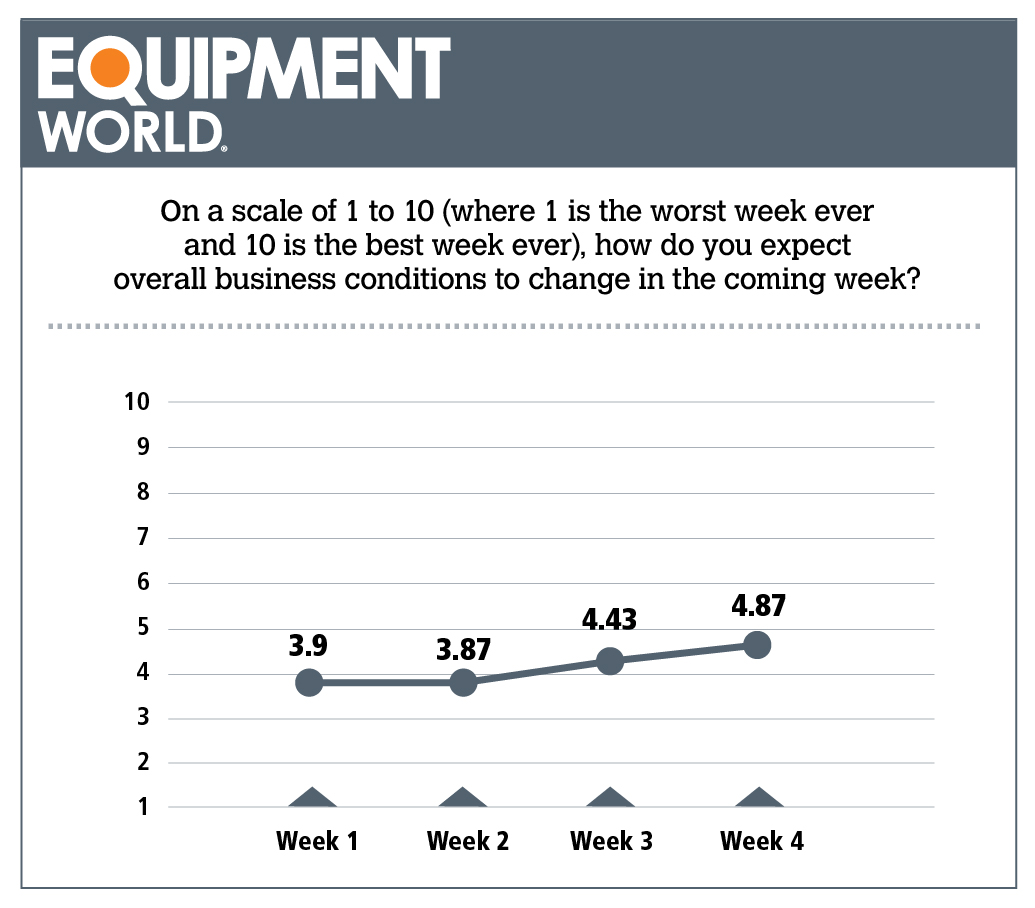

Finally, a little good news: In Week 4 of the Equipment World survey of contractor sentiment about the COVID-19 coronavirus impact, respondent optimism levels have inched up.

Finally, a little good news: In Week 4 of the Equipment World survey of contractor sentiment about the COVID-19 coronavirus impact, respondent optimism levels have inched up.

Each week of the survey we’ve asked: “On a scale of 1 to 10 (where 1 is the worst week ever and 10 is the best week ever), how do you expect overall business conditions to change in the coming week?”

For the past two weeks that number has slowly increased, from 3.9 in Weeks 1 and 2, to 4.43 in Week 3 to 4.87 in Week 4. The gains are small but for now are going in a positive direction.