Investment Rate Drops Across Five Heavy Equipment Markets | Dump Truck Company

Five key markets for construction charlotte nc dump trucks dealers showed varying levels of decline in this month’s U.S.

Equipment & Software Investment Momentum Monitor report released by the foundation arm of the Equipment Leasing & Finance Association.

Looking at the year-over-year monitor results in the construction, agriculture, mining, materials handling and trucking markets, trucking led declines, reporting a 41 percent decrease, followed by construction equipment, which saw a 27 percent decrease.

Published monthly, the index is based on a series of custom leading indicators on 12 market verticals developed for Equipment Leasing & Finance Foundation by Keybridge LLC. It is designed to signal the direction and magnitude of growth in charlotte nc dump trucks investment over the next six months.

ELFF’s October overview of vertical markets includes:

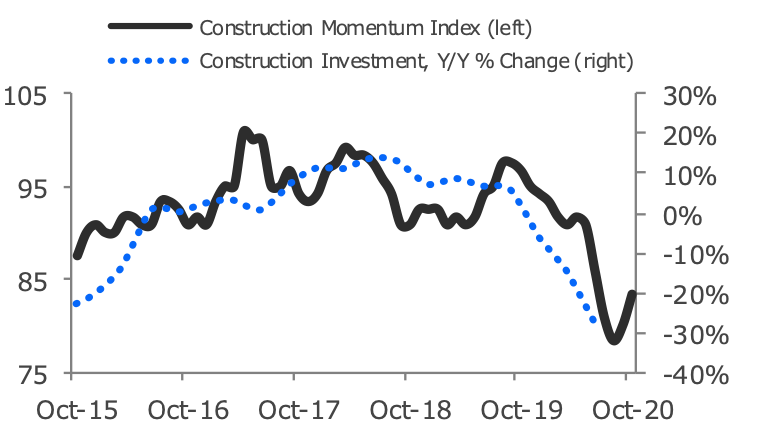

Construction machinery: Investment in Construction Machinery collapsed 44 percent on annualized basis in Q2 2020 and is down 27 percent year-over-year. The Construction Momentum Index rose from 80.2 (revised) in September to 83.5 in October, but ELFF says it remains exceptionally weak. In August, private homes under construction rose 1.5 percent, and the Commercial Property Price Index was down 14 points from February levels. “Overall, the index points to continued weakness in construction machinery investment over the next one to two quarters, but recent movement is encouraging,” ELFF says.

Construction machinery: Investment in Construction Machinery collapsed 44 percent on annualized basis in Q2 2020 and is down 27 percent year-over-year. The Construction Momentum Index rose from 80.2 (revised) in September to 83.5 in October, but ELFF says it remains exceptionally weak. In August, private homes under construction rose 1.5 percent, and the Commercial Property Price Index was down 14 points from February levels. “Overall, the index points to continued weakness in construction machinery investment over the next one to two quarters, but recent movement is encouraging,” ELFF says.

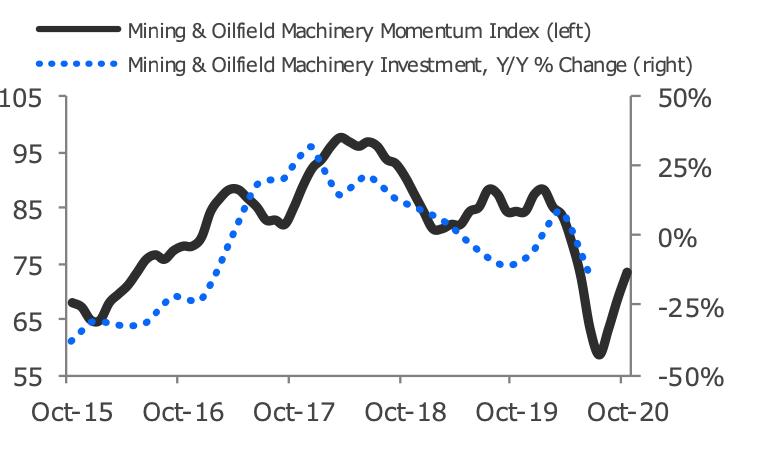

Mining & oilfield machinery: Investment in this sector pulled back at a 55 percent annualized rate in Q2 2020 and fell 13 percent compared to a year ago. The Mining & Oilfield Machinery Momentum Index improved from 68.8 (revised) in September to 73.4 in October. “Overall, the Index points to a potential improvement in mining and oilfield investment growth over the next six months, though the global recession is likely to remain a significant headwind for energy demand,” says the association.

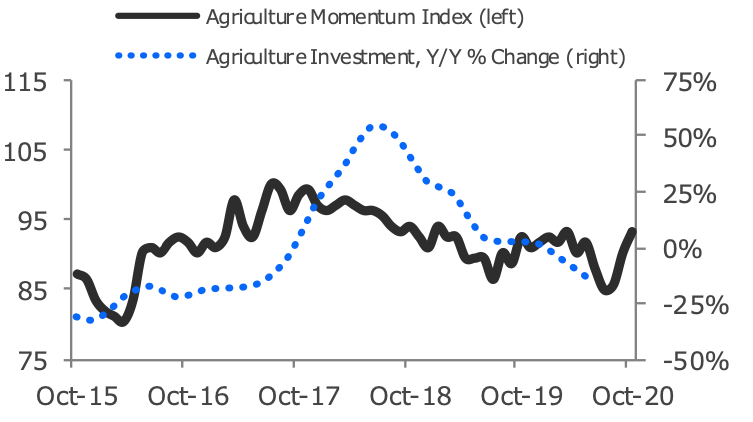

Agricultural machinery: Investment dropped 39 percent (annualized) in Q2 2020 and is down 16 percent from one year ago. The Agriculture Momentum Index improved from 90.3 (revised) in September to 93.3 in October. In August, the M1 Money Supply rose 1.2%, but Lamb & Mutton Production fell 11%, the sharpest monthly decline since late 2019. Overall, the index suggests that agricultural machinery investment growth may have hit a turning point and should begin to improve over the next six months, ELFF says.

Agricultural machinery: Investment dropped 39 percent (annualized) in Q2 2020 and is down 16 percent from one year ago. The Agriculture Momentum Index improved from 90.3 (revised) in September to 93.3 in October. In August, the M1 Money Supply rose 1.2%, but Lamb & Mutton Production fell 11%, the sharpest monthly decline since late 2019. Overall, the index suggests that agricultural machinery investment growth may have hit a turning point and should begin to improve over the next six months, ELFF says.

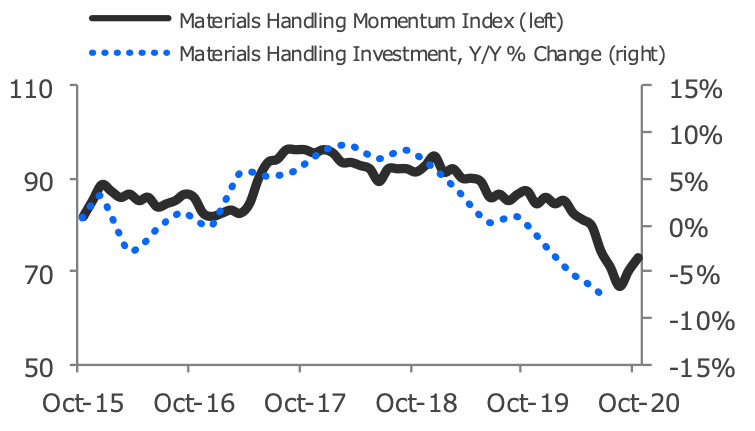

Materials handling equipment: Investment fell at a 13 percent annualized rate in Q2 2020 and is down 7.3 percent year-over- year. The Materials Handling Momentum Index increased from 70.2 (revised) in September to 73.0 in October. Industrial sector energy consumption fell 1.9 percent in June, while private warehouse construction spending eased 0.8 percent in August. ELFF anticipates continued contraction in materials handling charlotte nc dump trucks investment over the next six months.

Materials handling equipment: Investment fell at a 13 percent annualized rate in Q2 2020 and is down 7.3 percent year-over- year. The Materials Handling Momentum Index increased from 70.2 (revised) in September to 73.0 in October. Industrial sector energy consumption fell 1.9 percent in June, while private warehouse construction spending eased 0.8 percent in August. ELFF anticipates continued contraction in materials handling charlotte nc dump trucks investment over the next six months.

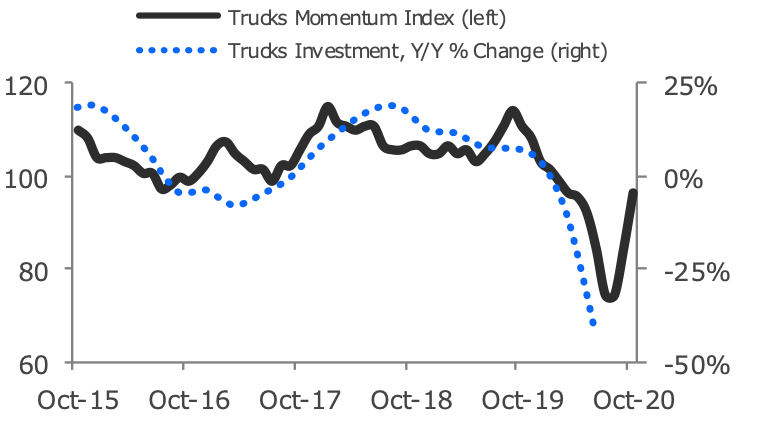

Trucks: Investment nosedived at an 82 percent annualized rate in Q2 2020 and is down 41 percent from year-ago levels. The Trucks Momentum Index surged from 84.7 (revised) in September to 96.6 in October. Manufacturers’ inventories of light trucks and utility vehicles declined 1.3 percent in July; however, earnings for freight trucking grew 1.4 percent in August. General indicators point to a potential recovery in trucks investment growth over the next two quarters, ELFF says.

Trucks: Investment nosedived at an 82 percent annualized rate in Q2 2020 and is down 41 percent from year-ago levels. The Trucks Momentum Index surged from 84.7 (revised) in September to 96.6 in October. Manufacturers’ inventories of light trucks and utility vehicles declined 1.3 percent in July; however, earnings for freight trucking grew 1.4 percent in August. General indicators point to a potential recovery in trucks investment growth over the next two quarters, ELFF says.